PCI DSS Compliance for Fintech Companies

Last Updated on February 26, 2026 by Narendra Sahoo PCI

Hire expert PCI DSS compliance consultants to achieve certification faster. Our certified QSAs deliver complete PCI DSS audits from gap assessment to Report on Compliance in 3 – 6 months.

Achieving PCI DSS compliance is mandatory for every organization that stores, processes, or transmits cardholder data. Our certified PCI DSS consultants deliver end-to-end audit services that protect your payment environment and satisfy acquirer requirements.

The Payment Card Industry Data Security Standard (PCI DSS) is a global security framework mandated by Visa, Mastercard, American Express, Discover, and JCB. Any merchant, payment processor, or service provider handling cardholder data must meet PCI DSS requirements or face steep penalties, card brand fines, and reputational damage.

At VISTA InfoSec, our PCI DSS compliance consultants guide you through every stage of the process from initial scoping and gap analysis to control implementation, evidence collection, and final Report on Compliance (ROC) or Self-Assessment Questionnaire (SAQ). Whether you’re undergoing your first PCI DSS audit or transitioning to PCI DSS v4.0, our team ensures a smooth, efficient path to certification.

With over 20 years of payment security expertise, ISO/IEC 27001 certification, CREST accreditation, and PCI SSC certified Qualified Security Assessors (QSAs) on staff, we deliver rigorous PCI DSS audits with zero surprises. For organizations managing multiple frameworks simultaneously, our AuditFusion360 service integrates PCI DSS controls with ISO 27001, SOC 2, or SWIFT CSP into a single, cost efficient audit engagement.

Partnering with VISTA InfoSec means more than passing an audit it means building a payment security posture that earns the trust of acquiring banks, card brands, and your customers.

Demystifying PCI DSS compliance, audit types, and the role of a qualified consultant in achieving certification.

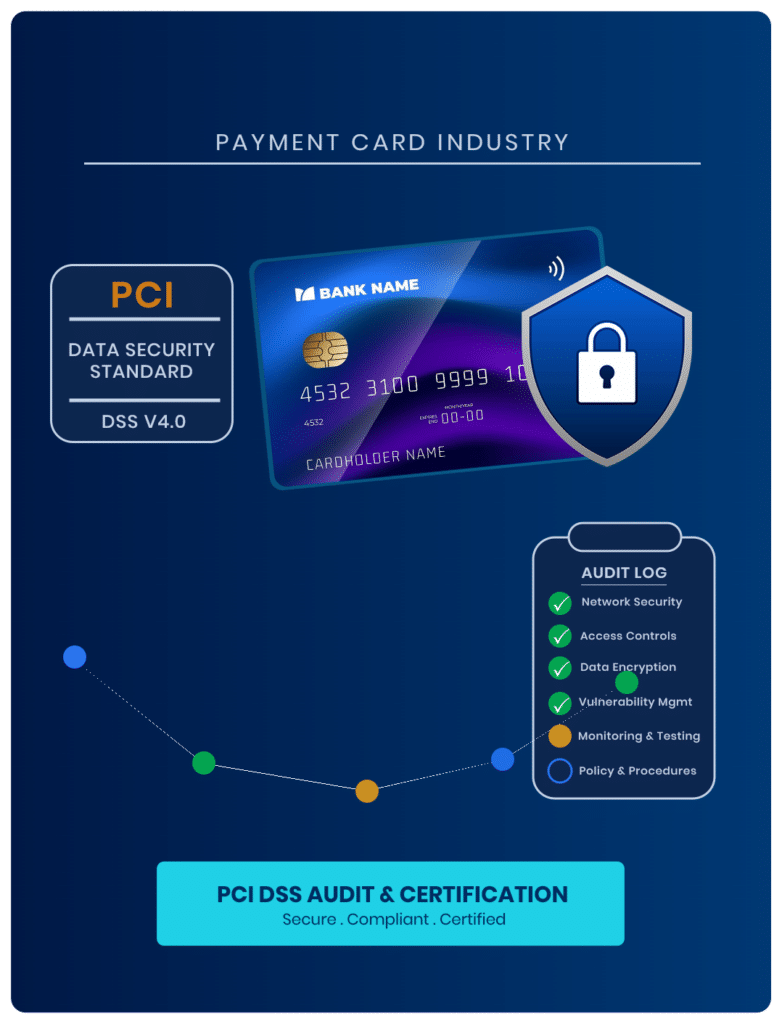

A PCI DSS audit is an independent assessment of your cardholder data environment (CDE) against the 12 PCI DSS requirements. Conducted by a Qualified Security Assessor (QSA), the audit validates that your controls meet card brand mandates for data protection, network security, access management, monitoring, and testing. The outcome is either a Report on Compliance (ROC) or a validated Self-Assessment Questionnaire (SAQ).

A PCI DSS compliance consultant prepares your organization for the audit—scoping the CDE, remediating gaps, and implementing required controls. A QSA auditor independently validates your compliance. At VISTA InfoSec, our PCI DSS consultancy delivers both roles: advisory services to build your security controls and certified QSA-led audits to issue your official Certification.

Every entity that stores, processes, or transmits payment card data must comply with PCI DSS—regardless of size. Non-compliance exposes your business to card brand fines of $5,000–$100,000 per month, liability for fraudulent transactions, mandatory forensic investigations, and potential termination of payment processing privileges. Hiring experienced PCI DSS consultants is the fastest route to sustainable compliance.

Our certified PCI DSS consultants will guide you through the entire Certification process. 100% pass rate guaranteed.

End-to-end PCI DSS consultancy from scoping and gap analysis to QSA led audit and annual maintenance.

Our PCI DSS consultants precisely define your cardholder data environment (CDE), identify all in-scope systems, and conduct a thorough gap analysis against all 12 PCI DSS requirements. You receive a detailed remediation roadmap before any audit work begins so you know exactly where you stand and what needs to be fixed.

Not all merchants require a full QSA led audit. Our PCI DSS compliance consultants determine the correct SAQ type for your business model SAQ A, B, C, D, or P2PE and guide you through accurate completion and submission, reducing compliance burden while maintaining full card brand acceptance.

For Level 1 merchants and service providers, our PCI SSC certified QSAs conduct a comprehensive on-site or remote PCI DSS audit. We assess all 12 requirements, test your controls, review evidence, and issue an official Report on Compliance (ROC) and Certification of Compliance (AOC) accepted by all major card brands.

Identified gaps during your PCI DSS readiness assessment? Our experienced consultants implement the missing technical and procedural controls network segmentation, encryption, logging, access controls, patch management, and more ensuring you achieve compliance without disrupting your payment operations.

PCI DSS audits require extensive documentary evidence. Our PCI DSS compliance consultants manage your entire evidence portfolio automating collection, organizing policies and procedures, and presenting documentation to QSA auditors in the prescribed format to accelerate your Certification timeline.

PCI DSS v4.0 introduces significant changes including customized controls and enhanced authentication requirements. Our consultants guide your transition from PCI DSS v3.2.1, implement new requirements, and provide ongoing compliance maintenance programs to keep your certification current year after year.

Our QSAs hold active PCI SSC certifications and audit payment environments across merchant, acquirer, processor, and service provider categories bringing real world depth to every PCI DSS engagement.

Across 200+ PCI DSS audits, every VISTA InfoSec client has achieved compliance. Our rigorous pre-audit readiness program eliminates surprises and guarantees you never face a failed assessment.

Our proven PCI DSS methodology compresses typical 9–18 month audit timelines to just 3–6 months. Faster certification means earlier revenue protection and quicker acquirer satisfaction.

Every engagement includes a dedicated senior PCI DSS compliance consultant who serves as your single point of contact from initial scoping through final Certification and annual maintenance.

Our PCI DSS audit services are priced clearly with no hidden fees. You receive a fixed-scope proposal before we begin—so you can budget confidently and avoid cost overruns common with other firms.

Using AuditFusion360, we combine your PCI DSS audit with ISO 27001, SOC 2, or SWIFT CSP in a single integrated engagement reducing duplicate evidence collection and cutting total compliance costs by up to 40%.

Our PCI DSS consultants help you select the right validation method based on your merchant level, business model, and card brand requirements.

Simplified PCI DSS Compliance Validation

✔ Suitable for merchants processing fewer than 6 million transactions annually

✔ Multiple SAQ types (A, B, C, D, P2PE) based on payment environment

✔ Faster completion timeline — typically 4–8 weeks with consultant support

✔ Lower cost than a full QSA-led audit engagement

✔ Our consultants determine correct SAQ type and guide accurate completion

Best for: E-commerce merchants, small retailers, and service providers not required by their acquirer to undergo a full QSA audit. Our PCI DSS consultancy ensures accurate SAQ completion and card brand acceptance.

Report on Compliance (ROC) & AOC Certification

✔ Mandatory for Level 1 merchants processing 6M+ transactions annually

✔ Required for all service providers storing, processing, or transmitting cardholder data

✔ Comprehensive assessment of all 12 PCI DSS requirements and sub-requirements

✔ Official ROC and AOC accepted by Visa, Mastercard, Amex, Discover, and JCB

✔ Our QSAs deliver thorough audits with full card brand compliance validation

Best for: Large merchants, payment processors, acquirers, gateways, and service providers requiring full Certification. Hire VISTA InfoSec’s certified QSAs for a rigorous, acquirer-accepted PCI DSS audit.

Book a free 30-minute strategy session with our certified PCI DSS compliance consultants.

Expert answers from certified PCI DSS consultants and auditors

PCI DSS compliance consulting costs vary based on your merchant level, cardholder data environment complexity, and validation type. SAQ based engagements typically range from $5,000 – $15,000 while full QSA led ROC audits range from $20,000–$75,000. Consider that PCI DSS non-compliance penalties from card brands can reach $5,000 – $100,000 per month, plus unlimited liability for breach-related fraud losses. VISTA InfoSec provides transparent fixed-fee proposals with no hidden costs contact us for a tailored quote.

With our experienced PCI DSS compliance consultants, SAQ completion takes 4–8 weeks and full QSA-led ROC audits are typically completed in 3–6 months from initial kickoff to final attestation. Organizations attempting PCI DSS compliance without expert consultant support commonly spend 9–18 months and often face audit findings that delay certification. Our structured methodology and dedicated consultant model eliminate these delays.

A Self-Assessment Questionnaire (SAQ) is a self-validation tool for smaller merchants who meet specific eligibility criteria different SAQ types (A, B, C, D, P2PE) apply to different payment environments. A Report on Compliance (ROC) is a formal assessment conducted by a PCI SSC-certified QSA, required for Level 1 merchants and most service providers. Our PCI DSS consultants determine which path applies to your organization based on your transaction volumes, business model, and acquiring bank requirements.

Hiring an experienced PCI DSS compliance consultant significantly reduces your risk of audit failure, accelerates certification, and prevents costly remediation after an assessment. PCI DSS has 12 main requirements with hundreds of sub-requirements—navigating scoping, control implementation, and evidence collection without expert guidance routinely leads to missed requirements, delayed audits, and expensive findings. Our 100% pass rate across 200+ engagements demonstrates the value of working with certified consultants from day one.

With VISTA InfoSec as your PCI DSS compliance consultant, audit failure is not an outcome you need to worry about. Our pre-audit readiness program validates every control before QSA testing begins. In the rare event that audit findings arise during assessment, our team remediates them immediately. We back our PCI DSS audit services with a 100% compliance guarantee if you don't achieve attestation, we re-engage at no additional cost.

PCI DSS v4.0, effective March 2024, introduces enhanced requirements for authentication (MFA expansion), web security (e-skimming prevention), targeted risk analysis, and a new customized approach option allowing flexible control implementation. Organizations still using v3.2.1 processes must comply with all new v4.0 future-dated requirements by March 2025. Our PCI DSS consultants provide dedicated v4.0 transition assessments that identify gaps in your current controls and implement the required changes efficiently.

Last Updated on February 26, 2026 by Narendra Sahoo PCI

Last Updated on January 30, 2026 by Narendra Sahoo 1️⃣What

Last Updated on February 17, 2026 by Narendra Sahoo PCI

Last Updated on January 5, 2026 by Narendra Sahoo As

VISTA InfoSec LLC,347 Fifth Ave,

Suite 1402-526, New York, NY 10016

© Copyright 2026. VISTA InfoSec. All Rights Reserved. | Disclosure Policy | Privacy Policy | Sitemap

Enquire Now

WhatsApp us